CUSTOMER SPOTLIGHT

Meet Blake, owner of Guapaholics

See how Blake leveraged Nav to look favorable in front of the SBA

His story

Beyond bootstrapping

Blake Milam started a T-shirt business in his dorm room as way to express himself. He would screenprint in the living room and dry shirts in the oven. Soon enough, orders started racking up. As profits grew, he’d invest them back into the business.

Blake started to realize that bootstrapping wasn’t going to get him the growth he wanted. He found Nav Prime, and started leveraging tradeline reporting to build his foundation. When a tornado came through his town, the business profile he had built with Nav helped him get a disaster grant from the SBA.

“When the SBA looked at my business, they saw that I was making on-time payments and had some tradelines. That [got] me to the next step to get a grant.”

— Blake Milam

financial health platform

Blake used Nav to set his foundation

Nav’s platform is designed to help you build a financially healthy business that looks favorable in front of lenders, vendors, and potential clients. Blake uses all the features to help him fine-tune his business.

Nav Prime helped him establish a business profile. With the FICO SBSS add-on, he was able to track the score that the SBA used so that he could improve it.

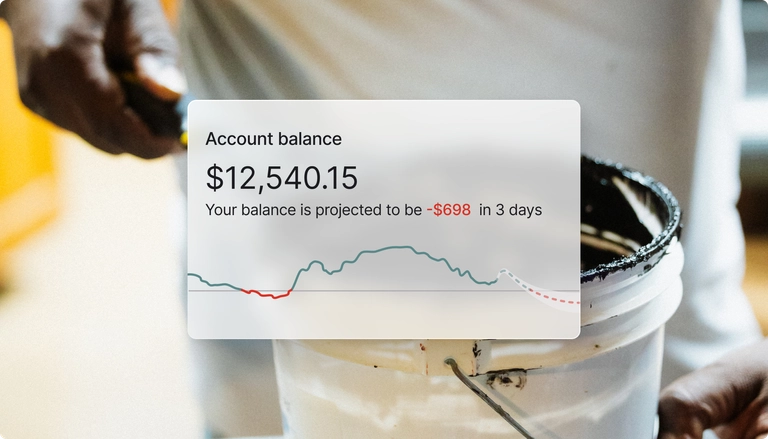

Cash flow health

Cash Flow Health motivates Blake

Blake says that when he sees his balances going toward the red, he knows he needs to step up his marketing to get more sales. The cash flow forecasting feature helps him to see and plan ahead, before he experiences any shortfalls.

nav prime

Blake uses Nav Prime to scale his business

Nav Prime helps maturing businesses like Guapaholics track and improve the financial factors that lenders care about, so they can grow beyond bootstrapping.

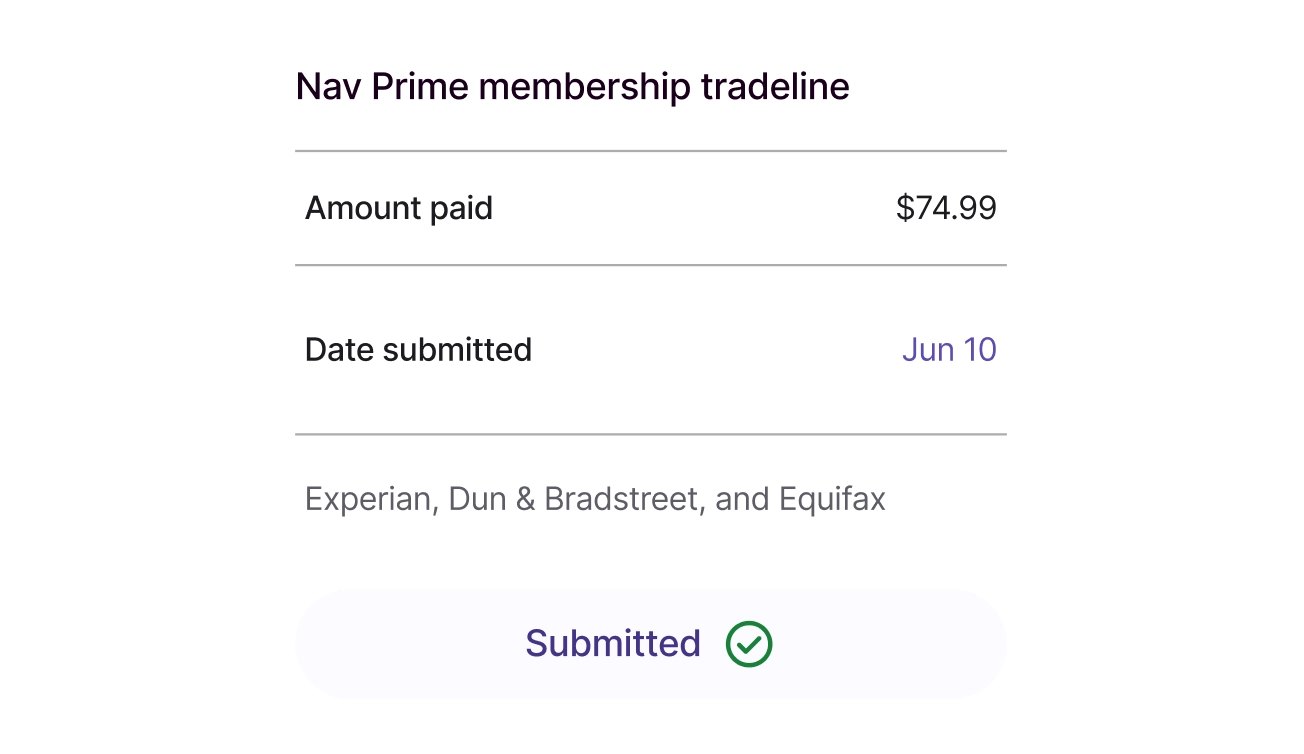

tradeline reportinG

Blake builds his business credit with Nav Prime

The tradeline he gets from his Nav Prime membership goes toward helping him build business credit history.

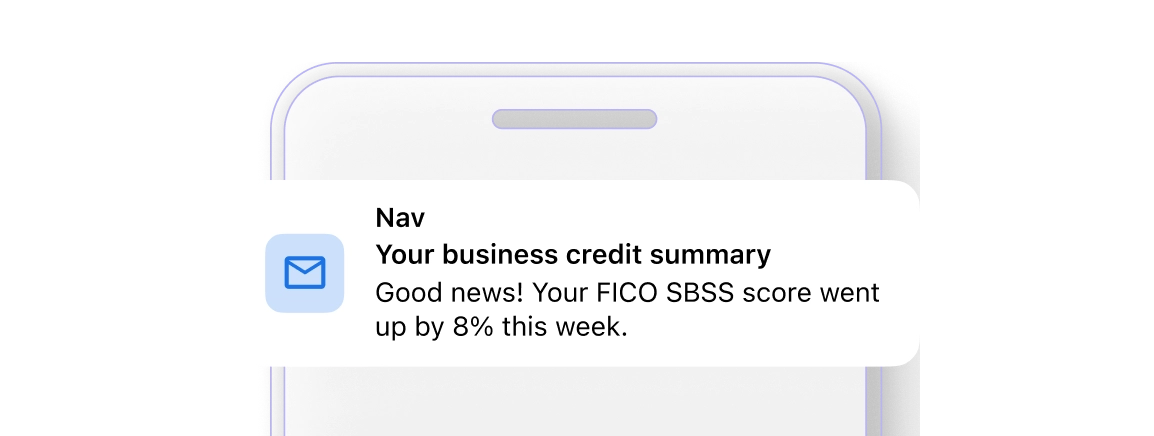

CREdit health

He keeps tabs on his credit

Blake tracks his complete business credit profile, including his FICO SBSS score, so he could work toward improving it.

You didn’t start your business because you love business credit

But that’s why we started ours. Nav isn’t just a powerful suite of financial tools — we’re part of your team.